Thunder Bay, ON, April 17, 2024 – Benton Resources Inc. (“Benton” or the “Company”) (TSXV: BEX) is pleased to announce that it has received further high-grade copper results from the Great Burnt Copper Deposit in Newfoundland further delineating the high-grade copper core. In addition, the Company’s ongoing efforts and interpretation of the recently completed down-hole geophysical program have confirmed a highly conductive anomaly extending to the south and along strike from hole GB-24-34. This high-priority target has been selected for drilling in the next phase of the drill program. The survey’s success will assist in identifying and prioritizing other targets on a regional scale as the summer exploration season ramps up.

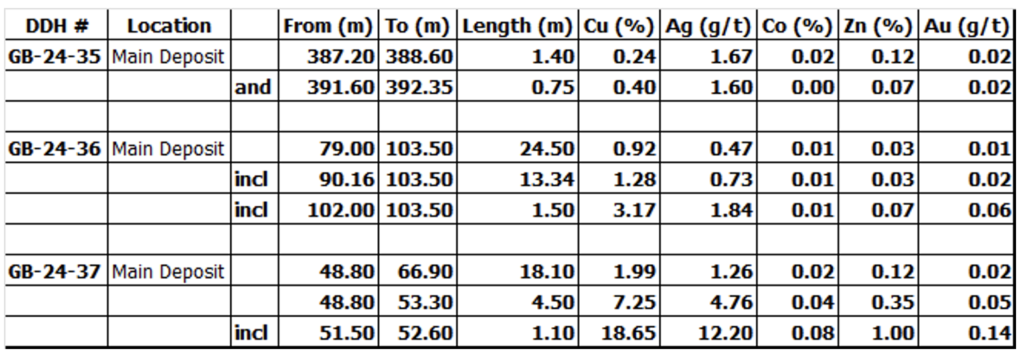

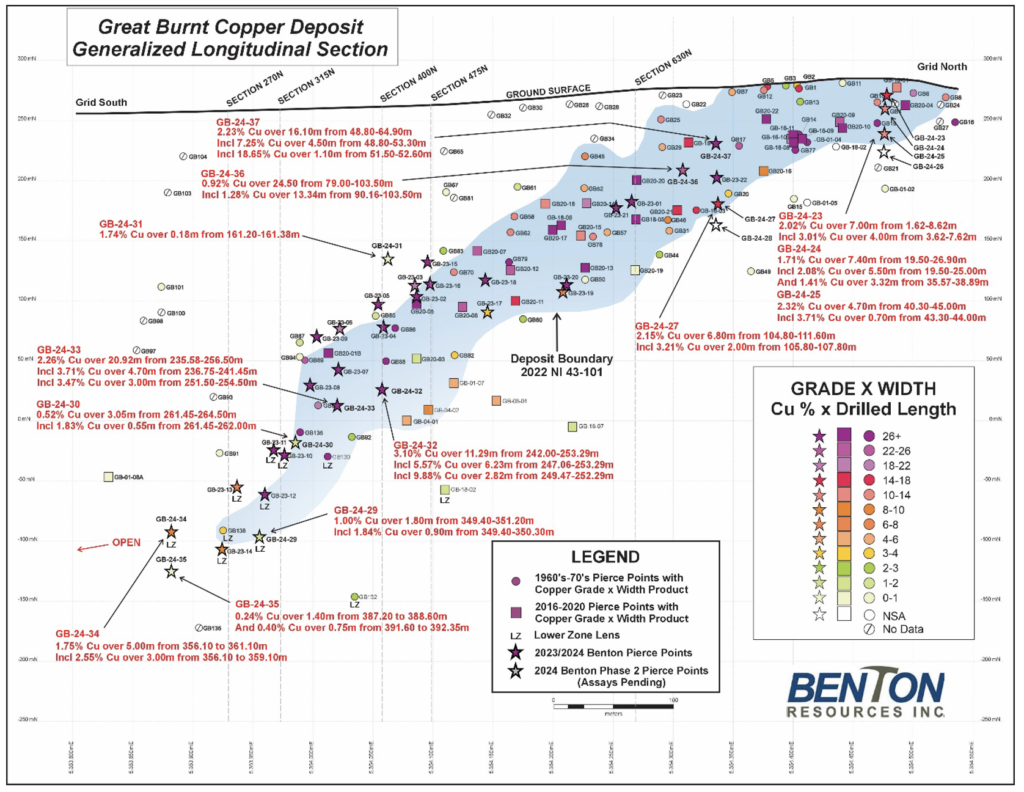

Holes GB-24-36 and GB-24-37 were infill drill holes near the centre of the deposit in larger gaps that continue to confirm significant copper mineralization in the Main Zone. GB-24-37 returned 1.99% Cu over 18.10 m, including 7.25% Cu over 4.50 m and18.65% Cu over 1.10 m. GB-24-36 also cut a wide interval of copper with 1.28% over 13.34 m, including 3.17% over 1.50 m.

GB-24-35 was drilled approximately 20 m down dip below GB-24-34 which previously reported 1.75% Cu over 5.00 m, including 4.02% Cu and 1.68% Zn over 1.00 m. GB-24-35 cut several small zones of semi-massive and stringer sulphides believed to be near the bottom of the VMS system where anomalous values grading 0.24% Cu over 1.40 m and 0.40% Cu over 0.75 m were obtained. The Company is planning to drill the zone up dip in the next drill program.

Table 1

Figure 1

Corporate Update

The Company would also like to announce the appointment of Alan King to its advisory board. Alan received a B.Sc. in Geology from the University of Toronto in 1976 and an M.Sc. in Geophysics from Macquarie University in 1989. From 1976 to 1990, he worked as a geophysicist in exploration and resource development in Canada and Australasia. From 1990 to 2012, he was employed by Inco /Vale as a senior geophysicist and then as Manager of Geophysics with responsibility for global exploration.

As Chief Geophysicist for Vale Global Exploration, Alan worked on geophysical applications for base metals, iron, manganese, coal and fertilizers (potash and phosphate) as well as target generation using regional and global data sets. Alan is currently working as a consultant with his own company Geoscience North.

His professional interests include the use of geophysics, new technology (and ideas), and data integration in exploration, mining, environmental, geotechnical and other applications. Pursuant to this appointment, the Company has granted 150,000 incentive stock options to Alan King at an exercise price of $0.20 for a period of five years from the date of grant. The options are subject to the vesting provisions contained within the Company’s stock option plan.

Stephen Stares, President and CEO of Benton stated, “We are pleased to welcome Alan to Benton’s advisory board. His invaluable experience and expertise will be critical to helping Benton advance the Great Burnt Deposit forward. Since we acquired the project in late 2023, we continue to have tremendous success. From intersecting significant grades and thicknesses, discovery of new high-grade surface samples, to identifying new geophysical targets, it’s truly been a pleasure to explore this highly prospective property. With each step forward, it is becoming apparent that Great Burnt will deliver further positive and exciting results as we move into the next phase of work. This program will commence with drilling at the South Pond area where there’s significant copper and gold historically and in recent sampling, followed by drilling new EM targets as well as deeper drilling on the Great Burnt Deposit to the south”.

In addition, the Company is pleased to announce that it has received TSX Venture Exchange approval for its previously announced non-brokered private placement (see Company news releases dated April 3 and April 12, 2024) and has closed the financing accordingly. The Company issued 15,755,334 units at a price of $0.15 per unit, each unit consisting of 1 common share of the Company and ½ (one half) of a common share purchase warrant, with each full warrant entitling the holder to acquire an additional common share of the Company at $0.22 for a period of 24 months from the date of issue for aggregate gross proceeds of $2,363,300. In connection with the financing, the Company paid $132,213 in cash finders’ fees and issued 881,420 finders’ warrants exercisable at $0.22 for 24 months from the date of issue. All securities issued pursuant to the private placement are subject to a four-month hold period.

QA/QC Protocols

Core and rock samples, including standards, blanks and duplicates, are submitted to Eastern Analytical Ltd., Springdale, Newfoundland for preparation and analysis. All samples were acquired by saw-cut (channels/drill core) with one-half submitted for assay and one-half retained for reference, or hand (rocks) and delivered, by Benton personnel, in sealed bags, to the Springdale lab of Eastern Analytical, which is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analysed using Eastern’s Au (Fire assay) @ 30g + ICP-34 method that delivers a 35-element package utilizing a 200mg subsample totally dissolved in four acids and analysed by ICP-OES analytical technique. Overlimits are analysed with Eastern’s atomic absorption method, using a 0.200g to 2.00g of sample, digested with three acids. All reported assays are uncut. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website).

QP

Stephen House (P.Geo.), Vice President of Exploration for Benton Resources Inc., the ‘Qualified Person’ under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

About Benton Resources Inc.

Benton Resources is a well-financed mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Benton has a diversified, highly prospective property portfolio and holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton is focused on advancing its high-grade Copper-Gold Great Burnt Project in central Newfoundland, which has a Mineral Resource estimate of 667,000 tonnes @ 3.21% Cu Indicated and 482,000 @ 2.35% Cu Inferred. The Project has an excellent geological setting covering 25km of strike and boasts six known Cu-Au-Ag zones over 15km that are all open for expansion. Further potential for discovery is excellent given the extensive number of untested geophysical targets and Cu-Au soil anomalies. The Phase 1 drill program consisting of over 5,650m, completed in November 2023, returned impressive results including 25.42m of 5.51% Cu, including 9.78 m of 8.31% Cu, and 1.00 m of 12.70% Cu from hole GB-23-12.

On behalf of the Board of Directors of Benton Resources Inc.,

“Stephen Stares”

Stephen Stares, President

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-474-9020

Email: sstares@bentonresources.ca

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.