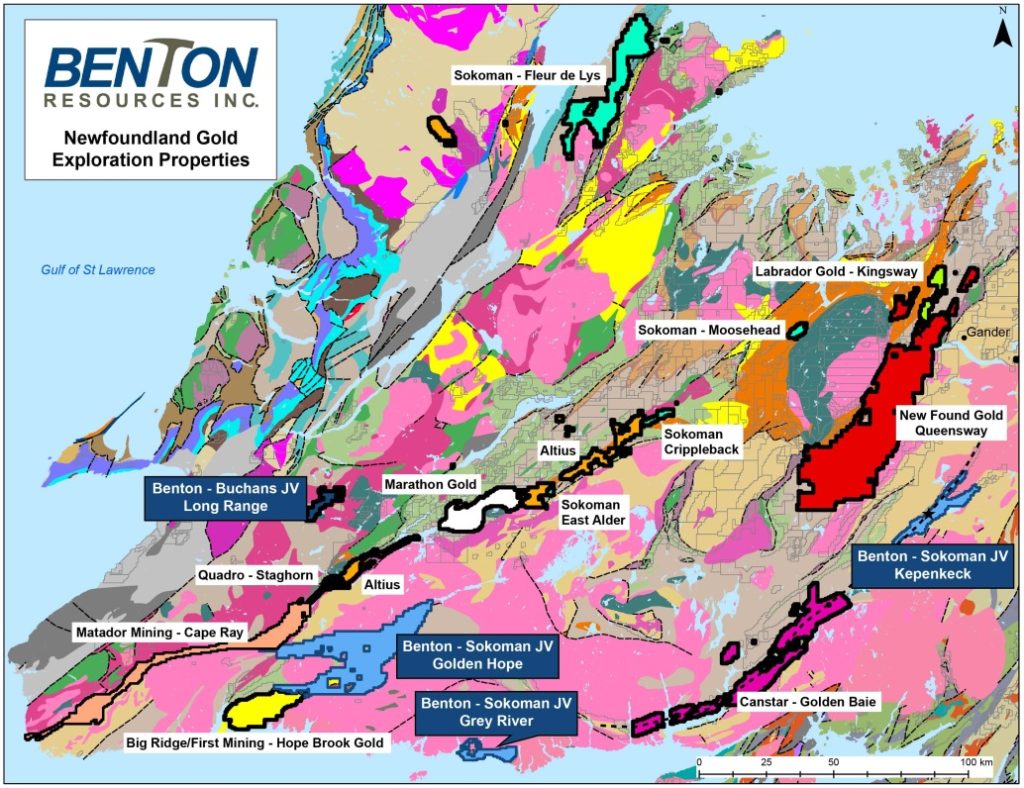

Thunder Bay ON, May 27, 2021 – Benton Resources Inc. (‘Benton’ or ‘the Company’) (TSX-V: BEX) is pleased to announce, together with Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”), the joint acquisition of the 324 claim (8,100 hectare) Grey River Gold Project in southern Newfoundland. The Property includes 11 claim units (275 hectares) optioned from local interests under letter agreements, more details to be released in the coming weeks. The Grey River acquisition is consistent with the newly formed Benton/Sokoman Alliance, which is targeting district-scale gold opportunities in Newfoundland.

The Grey River Gold Project is centered on the community of Grey River, a deep-water, ice-free harbour on the south coast of the Island of Newfoundland, 32 km east of the town of Burgeo, and 38 km southeast of the recently acquired Golden Hope Joint Venture (see Press Release dated May 20, 2021). The SIC-BEX claims straddle a fundamental east-west trending ductile shear zone that separates a large enclave of Late Precambrian amphibolite, gabbro, metasediments, felsic metavolcanics and mafic orthogneisses from a batholith-scale, syn-kinematic suite of Siluro-Devonian granitoid rocks. The east-west trending amphibolite-grade metamorphic units are correlatives of the coeval basement block exposed on-strike, farther west in the Hermitage Flexure, near Burgeo and at Hope Brook. The east-west shear zone at Grey River, and parallel structures immediately offshore, are fundamental crustal breaks, along which several metal-rich mid- to late-Devonian granites were emplaced along the southern coast of the Island.

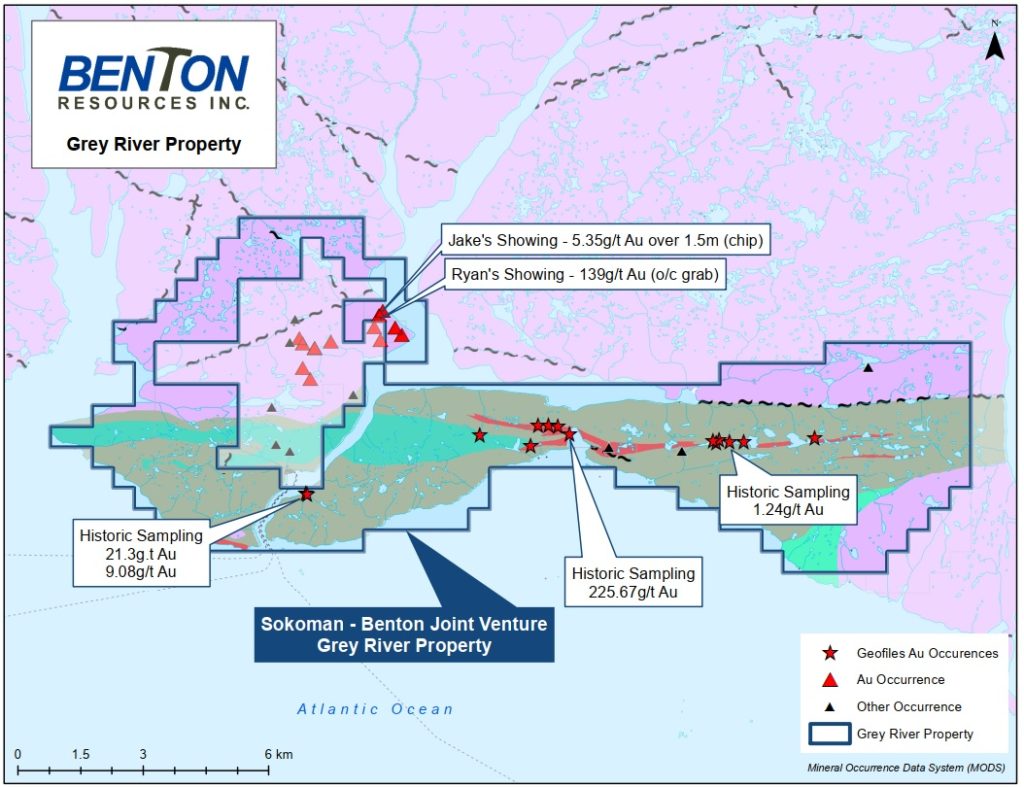

Rocks in this segment of the Hermitage Flexure are unusually enriched in gold (Au), molybdenum (Mo), copper (Cu), tungsten (W), fluorine (F) and bismuth (Bi). A 5-km-wide by 10-km-long area within and adjoining the property, between Grey River and Gulch Cove, is particularly metal-rich, hosting: i) multiple mesothermal and intrusion-related Au-rich (+/- Bi-Ag-Sb-Pb-Zn) quartz veins; ii) a porphyry Mo-Cu deposit (Moly Brook); iii) a vein-type wolframite-rich W deposit (Grey River #10); and iv) a unique, diffusely bounded, high-purity, locally auriferous silica deposit (Gulch Cove) of equivocal origin. Each appear to be associated with distinct features in the regional aero magnetics and are also reflected in regional Government lake-sediment geochemistry coverage of the area. The primary focus of upcoming SIC-BEX exploration is quartz-vein-hosted, structurally controlled and intrusion-related, high-grade Au (+/- Ag, Bi, Sb) in both the granitic and adjacent metamorphic terranes.

Previous exploration at Grey River identified gold in several settings: in base-metal-rich and sulfide-poor, quartz veins and veinlets in the gneisses and related metamorphic rocks, including regional-scale silica bodies; in quartz veins with coarse-grained sulfides in granite; in sulfide-poor, quartz stock-work in sericitized granite; and in stockwork-style quartz and quartz-sulfide veinlets with or without pervasive silica replacement in granite.

Gold grades reported from historic grab samples and channel samples from the property range from less than 1g/t to over 225 g/t Au, locally with 200-300 g/t Ag, with or without anomalous Bi, Sb (antimony) and W. The 225 g/t Au chip sample is from a 20-30 cm wide zone of pyritic alteration immediately adjacent to an 8-km-long, diffusely bounded quartz zone. The latter coincides with the large elongate high-purity silica body (12M tonnes >95% SiO) drilled by the Newfoundland Government in 1967 as part of an Island-wide silica assessment program. The diffusely bounded, irregularly shaped silica lies at the boundary of amphibolite gneisses and mica-schists, and within mica schists, along the flank of a prominent aeromagnetic high. Its origin is unclear and past workers have proposed differing origins (e.g., meta-quartzite; quartz vein; silica replacement zone). The style, grades, setting and Au-Ag-Bi-W-Sb geochemical signature of some of the gold mineralization led previous exploration groups to draw comparisons with the high-grade Pogo gold mine within the Tintina Gold Belt of Alaska and Yukon (gold in diffusely bounded quartz bodies within amphibolite grade gneisses). The Pogo mine, up to the end of 2019, had produced 3.9 million oz gold at 13.6 g/t gold, with reserves of over 7 million oz gold.

QP

Nathan Sims (P.Geo., PEGNL Member 09409), Senior Exploration Manager for Benton Resources Inc., the ‘Qualified Person’ under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

On behalf of the Board of Directors of Benton Resources Inc.,

“Stephen Stares”

Stephen Stares, President

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Most projects have an up-to-date 43-101 Report available.

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x231

Email: cathy@chfir.com

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.