Thunder Bay, ON, September 3, 2019 – Benton Resources Inc. (‘Benton’ or ‘the Company’) (TSX-V: BEX) announced today that it has amended (the ‘Amending Agreement’) the binding purchase agreement signed on July 2, 2019 with Panoramic Resources Inc. (‘Panoramic’) (the ‘PAN Agreement’)(see NR dated July 2, 2019).

Under the PAN Agreement, Benton has agreed to acquire all of Panoramic’s shares in its wholly-owned subsidiary, Panoramic PGMs Canada Ltd., which holds the Thunder Bay North PGM project (‘TBN’) for C$9.0 million in cash (the “Purchase Price”).

Amended Payment Terms

Benton will now pay the C$9 million Purchase Price over four installments, as set out below:

- C$4.5 million on the completion of the PAN Agreement;

- C$1.5 million on the first anniversary of the completion of the PAN Agreement;

- C$1.5 million on the second anniversary of the completion of the PAN Agreement; and

- C$1.5 million on the third anniversary of the PAN Agreement.

Security

The Company will pledge security for the three deferred payments by providing a first registered security over the TBN PGM Project Property and the shares of Panoramic PGMs Canada Ltd to Panoramic.

Conditions Precedent to Completion of the Sale

Completion of the sale of Panoramic PGMs Canada Ltd. to Benton is still subject to the following conditions precedent:

- signing a Definitive Agreement;

- receipt of any necessary regulatory approvals and shareholder approvals required by Benton;

- Benton raising sufficient finance to fund the Purchase Price;

- Rio Tinto Exploration Canada Inc. (“RTEC”) and Benton completing the acquisition by Benton of the Escape Lake Project from RTEC (see NR dated July 2, 2019); and

- Panoramic PGMs Canada Ltd. being released from its future obligations under the Earn-in with Option to Joint Venture Agreement (“EJVA”) with RTEC that was signed in July 2014.

Other Terms

- Definitive Agreement – the Amending Agreement states that both parties will complete and sign the Definitive Agreement within 30 days of the date of the Amending Agreement. If the Definitive Agreement is not signed within 30 days of the date of the Amending Agreement, the Amending Agreement will terminate. Panoramic can extend the 30-day period at its discretion; and

- All other terms of the Amending Agreement remain the same as was originally set out in the PAN Agreement.

Project Highlights:

- High-grade, near-surface Platinum Group Metals (PGM) deposits with a historical resource.

- Excellent infrastructure, with a paved highway and established logging roads.

- Drilling highlights on the 30,000 hectare Thunder Bay North (TBN) Property include historic high-grade intercepts of 46.65 m @ 10.1 g/t Platinum+Palladium+Gold (5.267g/t Pt + 4.555g/t Pd + 0.324g/t Au) with 1.62% Copper+Nickel (1.154% Cu + 0.465% Ni), incl. 13.0 m @ 33.2 g/t Pt+Pd+Au (17.305g/t Pt + 14.817g/t Pd + 1.061g/t Au) and 4.91% Cu+Ni (3.755% Cu + 1.308g/t Ni), incl. a spectacular intercept of 2.6 m @ 97.9 g/t Pt+Pd+Au (52.769g/t Pt + 41.538g/t Pd + 3.630g/t Au) and 14.9% Cu+Ni (11.599% Cu + 3.289% Ni) in drill hole BL 10-197.

Stephen Stares, President and CEO, stated: “We are delighted to have renegotiated the purchase terms with Panoramic which provides Benton with additional time to acquire the project resulting in less dilution early on. While the markets have been very difficult, platinum metals are preforming extremely well which makes this project extremely attractive. Benton will continue its efforts to finance the transaction in its entirety in the most efficient and non-dilutive way possible. With the project located only 50 km from the Company’s office in Thunder Bay, both projects are well-situated to aggressively move them forward. In addition, the projects lie approximately 60 km south of North American Palladium’s (NAP) Lac des Illes Mine and less then 10 km east of NAP/Transition Metals’ Sunday Lake Intrusion”.

Thunder Bay North

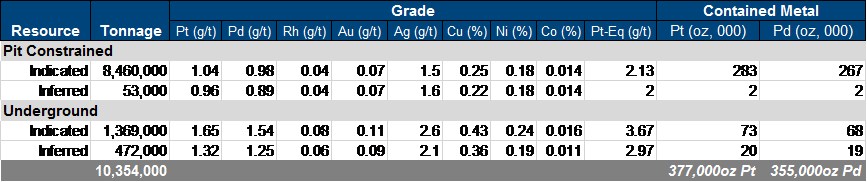

The TBN Project contains the Current, Bridge and Beaver zones of which the following Historical Estimates* are defined:

July 2, 2019).

Under the PAN Agreement, Benton has agreed to acquire all of Panoramic’s shares in its wholly-owned subsidiary, Panoramic PGMs Canada Ltd., which holds the Thunder Bay North PGM project (‘TBN’) for C$9.0 million in cash (the “Purchase Price”).

Amended Payment Terms

Benton will now pay the C$9 million Purchase Price over four installments, as set out below:

- C$4.5 million on the completion of the PAN Agreement;

- C$1.5 million on the first anniversary of the completion of the PAN Agreement;

- C$1.5 million on the second anniversary of the completion of the PAN Agreement; and

- C$1.5 million on the third anniversary of the PAN Agreement.

Security

The Company will pledge security for the three deferred payments by providing a first registered security over the TBN PGM Project Property and the shares of Panoramic PGMs Canada Ltd to Panoramic.

Conditions Precedent to Completion of the Sale

Completion of the sale of Panoramic PGMs Canada Ltd. to Benton is still subject to the following conditions precedent:

- signing a Definitive Agreement;

- receipt of any necessary regulatory approvals and shareholder approvals required by Benton;

- Benton raising sufficient finance to fund the Purchase Price;

- Rio Tinto Exploration Canada Inc. (“RTEC”) and Benton completing the acquisition by Benton of the Escape Lake Project from RTEC (see NR dated July 2, 2019); and

- Panoramic PGMs Canada Ltd. being released from its future obligations under the Earn-in with Option to Joint Venture Agreement (“EJVA”) with RTEC that was signed in July 2014.

Other Terms

- Definitive Agreement – the Amending Agreement states that both parties will complete and sign the Definitive Agreement within 30 days of the date of the Amending Agreement. If the Definitive Agreement is not signed within 30 days of the date of the Amending Agreement, the Amending Agreement will terminate. Panoramic can extend the 30-day period at its discretion; and

- All other terms of the Amending Agreement remain the same as was originally set out in the PAN Agreement.

Project Highlights:

- High-grade, near-surface Platinum Group Metals (PGM) deposits with a historical resource.

- Excellent infrastructure, with a paved highway and established logging roads.

- Drilling highlights on the 30,000 hectare Thunder Bay North (TBN) Property include historic high-grade intercepts of 46.65 m @ 10.1 g/t Platinum+Palladium+Gold (5.267g/t Pt + 4.555g/t Pd + 0.324g/t Au) with 1.62% Copper+Nickel (1.154% Cu + 0.465% Ni), incl. 13.0 m @ 33.2 g/t Pt+Pd+Au (17.305g/t Pt + 14.817g/t Pd + 1.061g/t Au) and 4.91% Cu+Ni (3.755% Cu + 1.308g/t Ni), incl. a spectacular intercept of 2.6 m @ 97.9 g/t Pt+Pd+Au (52.769g/t Pt + 41.538g/t Pd + 3.630g/t Au) and 14.9% Cu+Ni (11.599% Cu + 3.289% Ni) in drill hole BL 10-197.

Stephen Stares, President and CEO, stated: “We are delighted to have renegotiated the purchase terms with Panoramic which provides Benton with additional time to acquire the project resulting in less dilution early on. While the markets have been very difficult, platinum metals are preforming extremely well which makes this project extremely attractive. Benton will continue its efforts to finance the transaction in its entirety in the most efficient and non-dilutive way possible. With the project located only 50 km from the Company’s office in Thunder Bay, both projects are well-situated to aggressively move them forward. In addition, the projects lie approximately 60 km south of North American Palladium’s (NAP) Lac des Illes Mine and less then 10 km east of NAP/Transition Metals’ Sunday Lake Intrusion”.

Thunder Bay North

The TBN Project contains the Current, Bridge and Beaver zones of which the following Historical Estimates* are defined:

https://orders.newsfilecorp.com/files/3657/47442_dcf82ea44496c907_002full.jpg

*Historical Estimate from Thomas, D. et al. 2011: Magma Metals Limited, Thunder Bay North Polymetallic Project Ontario, Canada, NI 43-101 Technical Report on Preliminary Assessment.

Mineral Resources at the Thunder Bay North project are considered by Benton to be historic in nature. No qualified person as defined by NI 43-101 has done sufficient work for Benton to classify the historical estimates at Thunder Bay North as current. The Company believes that the historical estimates at both deposits can be used as a guide in determining future exploration drilling and the Company will need to undertake a comprehensive review of available data which may include further drilling to verify the historic estimates at either property in order to reclassify them as current mineral resources. The Company’s QP has verified the data but no resampling of core or any other tests on the analytical procedures has been performed by the Company to-date. Verification of results will be a top priority for Benton.

A map of the PGM Projects and drill hole locations can be viewed on the Company’s website along with the PEA provided by Panoramic Resources Inc. In addition, the Company has made available its updated corporate presentation covering these prospective PGM Projects on its web site at www.bentonresources.ca.

QP

Nathan Sims (P.Geo.), Senior Exploration Manager for Benton Resources Inc., the ‘Qualified Person’ under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

On behalf of the Board of Directors of Benton Resources Inc.,

“Stephen Stares”

Stephen Stares, President

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Most projects have an up-to-date 43-101 Report available.

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x231

Email: cathy@chfir.com

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.