Thunder Bay, ON, October 24, 2019 – Benton Resources Inc. (TSXV: BEX) (‘Benton’ or ‘the Company’) is pleased to announce that it has signed a binding option agreement (the “Option Agreement”) with Maxtech Ventures Inc. (“MVT”) pursuant to which MVT will have the option to earn up to a 100% interest in Benton’s 100%-owned Panama gold project (the “Project”) in the Red Lake Mining district, Ontario (see PR dated September 10, 2019). Under the terms of the Option Agreement, subject to regulatory approval, Maxtech will be required to complete the following:

- Issue 2,000,000 Maxtech common shares to Benton on signing at an underlying price of $0.05 per share;

- Pay Benton $100,000 in cash or share equivalent on the first anniversary, based upon a 10-day VWAP at the time of the share issuance and complete $200,000 in exploration expenditures on the Project;

- Pay Benton $100,000 in cash or share equivalent on the second anniversary, based upon a 10-day VWAP at the time of the share issuance and complete $250,000 in exploration expenditures on the Project at which point a 50% ownership interest will vest to MVT;

- Pay Benton $100,000 in cash or share equivalent on the third anniversary, based upon a 10-day VWAP at the time of the share issuance and complete $250,000 in exploration expenditures on the Project at which point a 70% ownership interest will vest to MVT; and

- Pay Benton $300,000 in cash or share equivalent on the fourth anniversary, based upon a 10-day VWAP at the time of the share issuance and complete $300,000 in exploration expenditures on the Project at which point a 100% ownership interest will vest to MVT

The Option Agreement contains a 2 km area of influence clause that covers the Project’s claim boundary. Benton will retain a 2% NSR on the Project with MVT having the option to buy back 1% for $1 million. In addition, MVT will issue to Benton an additional 1 million MVT common shares upon completion of its initial NI 43-101 compliant resource calculation as defined in the Option Agreement. Should Maxtech earn a 50% interest but elect to earn no additional interest, a 50% MVT 50% Benton joint venture would then be formed. Alternatively, should Maxtech earn a 70% interest in the Project but not elect to earn any further interest, a 70% MVT and 30% Benton joint venture would then be formed according to the terms of the Option Agreement.

Stephen Stares, President and CEO, stated: “We are excited to partner with Maxtech to advance this excellent project in the well-established and productive Red Lake gold camp. The project is well-situated along trend from Great Bear Resources’ discovery 50km to the west and has similar magnetic, structural and geological features associated with known gold mineralization.”

About the Panama Gold Project

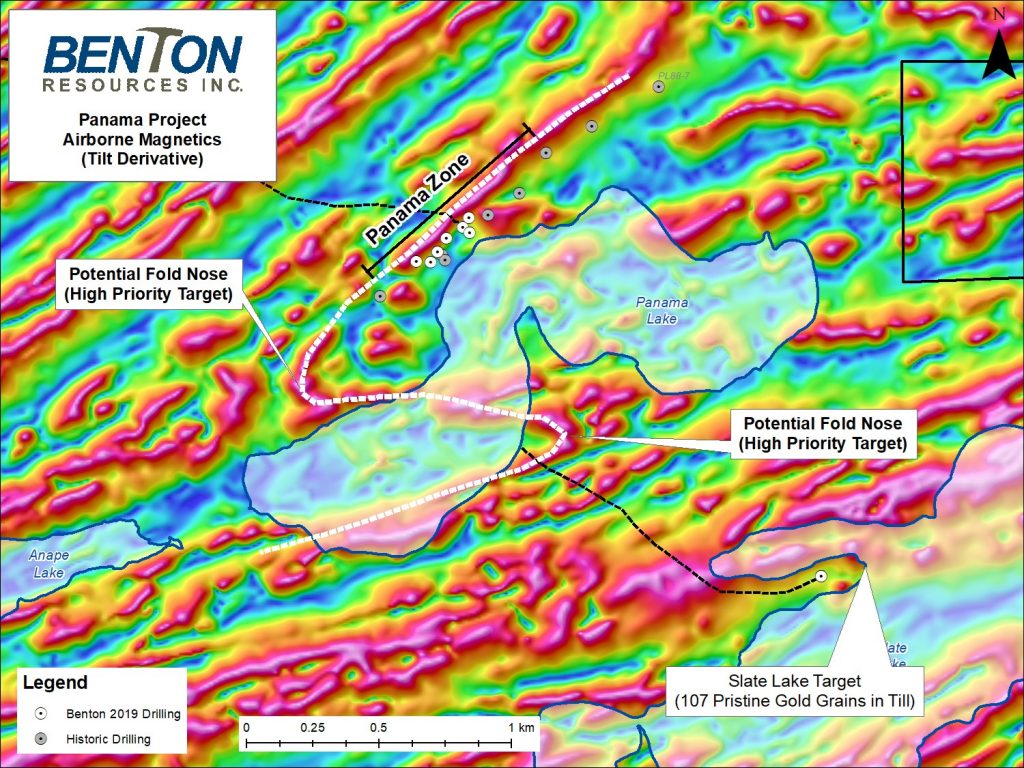

Benton acquired the project 100% via claim staking and has completed various phases of exploration including a recently completed drill program (see results below) and high-detail airborne mag survey which has identified several high-priority targets for immediate follow-up. These targets include a distinct fold approximately 250m along strike from the Panama Zone which has not been previously identified (see map below). Benton has also discovered, through a review of old assessment files, an occurrence containing visible gold in the northeast part of the project which requires follow up. In addition, the Panama project is host to some of the highest unsourced gold grains (107 grains) in glacial till discovered by the Geological Survey of Canada, 1999 (Open File 3038).

To view an enhanced version of Map 1, please visit:

https://orders.newsfilecorp.com/files/3657/49082_7577dec7a4eee826_002full.jpg

Highlights from Benton’s Phase I Drill are as follows (see NR dated March 27, 2019):

| Hole | From (m) | To (m) | Interval (m) | Gold (g/t) | Composite |

| PL-19-01 | 79.6 | 87.2 | 7.6 | 1.58 | 1.58 g/t over 7.6 m |

| incl | 79.6 | 84.3 | 4.7 | 2.34 | 2.34 g/t Au over 4.7 m |

| PL-19-02 | 148.5 | 155 | 6.5 | 1.23 | 1.23 g/t Au over 6.5 m |

| PL-19-03 | 79.6 | 85.4 | 5.8 | 1.21 | 1.21 g/t Au over 5.8 m |

| incl | 82.4 | 84.4 | 2 | 2.55 | 2.55 g/t Au over 2 m |

| PL-19-04 | 72.8 | 78.6 | 5.8 | 1.07 | 1.07 g/t Au over 5.8 m |

| incl | 75.8 | 78.6 | 2.8 | 1.67 | 1.67 g/t Au over 2.8 m |

| PL-19-05B | 77.5 | 93.6 | 16.1 | 0.57 | 0.57 g/t Au over 16.1 m |

| incl | 89 | 91 | 2 | 2.07 | 2.07 g/t Au over 2 m |

| PL-19-06 | 82 | 83 | 1 | 0.427 | 0.427 g/t Au over 1 m |

| PL-19-07 | 35.4 | 36.4 | 1 | 0.563 | 0.563 g/t Au over 1 m |

| PL-19-08 | 270.5 | 279 | 8.4 | 0.18 | 0.18 g/t Au over 8.4 m |

| PL-19-09 | 100 | 102 | 2 | 0.425 | 0.425 g/t Au over 2 m |

Note: Reported intercepts are core lengths, not true widths.

QP

Nathan Sims (P.Geo.), Senior Exploration Manager for Benton Resources Inc., the ‘Qualified Person’ under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

On behalf of the Board of Directors of Benton Resources Inc.,

“Stephen Stares”

Stephen Stares, President

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Most projects have an up-to-date 43-101 Report available.

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x231

Email: cathy@chfir.com

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.