Thunder Bay, ON, October 15, 2019 – Benton Resources Inc. (‘Benton’ or ‘the Company’) (TSX-V: BEX) is pleased to announce that it has signed a letter of intent (the “LOI“) with Regency Gold Corp. (“Regency“) (TSX-V: RAU) which sets out a proposed transaction pursuant to which Regency will acquire from Benton an option (the “Option”) to acquire the Company’s rights to acquire, under its pre-existing agreements with Rio Tinto Exploration (Canada) Inc. (“RTEC”) (the “RTEC Agreement”) and Panoramic Resources Inc. (“PAN”), a 100% right, title and interest in the Escape Lake Property (“Escape Lake”) and the Thunder Bay North Project (the “TBN Project”) respectively.

Proposed Transaction. It is contemplated that Regency, subject to regulatory approval and consent from RTEC and PAN, may exercise the Option by completing the following:

- Issuing to Benton an aggregate of 24,615,384 common shares (the “Regency Shares“) in the capital of Regency to Benton;

- Fulfilling the remaining terms of the underlying option agreement Benton has with RTEC on the Escape Lake property; and

- Issuing to Benton a 0.5% net smelter return royalty from production on the Escape Lake property and a 0.5% net smelter return royalty from production on any mineral claims comprising the TBN Project that a net smelter royalty has not previously been granted.

Regency Shares to be issued will be subject to a four-month and one day “hold period” from the date of closing of the LOI. Upon completion of the LOI, Regency will assume, be bound by and perform the obligations of Benton under the RTEC Agreement. Benton and Regency shall each have a due diligence period commencing upon the execution of the LOI and expiring 15 days thereafter. Following execution of the LOI, and subject to finalization of the terms of the Proposed Transaction, Regency will prepare and submit to Benton a Definitive Agreement.

Stephen Stares, President and CEO, stated: “With Impala Platinum’s recent $1 billion acquisition of North American Palladium and its Lac des Illes Mine which is located only 60 km north of our Platinum Group metal projects near Thunder Bay Ontario, it is an opportune time to advance our programs aggressively. Benton is delighted to be partnering with the Regency team which provides Benton shareholders with tremendous upside and exposure to these extremely prospective PGM projects while containing the significant dilution Benton was facing in order to finance the acquisitions on its own. Our team has worked diligently to keep the project package together in one issuer to ensure its full potential will be realized.”

Highlights:

- High-grade, near-surface Platinum Group Metals (PGM) deposits with a historical resource.

- Excellent infrastructure, with a paved highway and established logging roads.

- Drilling highlights on the 30,000 hectare Thunder Bay North (TBN) Property include historic high-grade intercepts of 46.65 m @ 10.1 g/t Platinum+Palladium+Gold (5.267g/t Pt + 4.555g/t Pd + 0.324g/t Au) with 1.62% Copper+Nickel (1.154% Cu + 0.465% Ni), incl. 13.0 m @ 33.2 g/t Pt+Pd+Au (17.305g/t Pt + 14.817g/t Pd + 1.061g/t Au) and 4.91% Cu+Ni (3.755% Cu + 1.308g/t Ni), incl. a spectacular intercept of 2.6 m @ 97.9 g/t Pt+Pd+Au (52.769g/t Pt + 41.538g/t Pd + 3.630g/t Au) and 14.9% Cu+Ni (11.599% Cu + 3.289% Ni) in drill hole BL 10-197.

- Drilling highlights on the 220 hectare Escape Lake Property include 121.6 m @ 2.49 g/t Pt+Pd+Au (1.04g/t Pt + 1.37g/t Pd + 0.07g/t Au) and 0.86% Cu+Ni (0.52% Cu + 0.34% Ni), incl. 33.4 m of 7.28 g/t Pt+Pd+Au (3.01g/t Pt + 4.08g/t Pd + 0.19g/t Au) and 2.26% Cu+Ni (1.49% Cu + 0.77% Ni) in drill hole 12CL0009, and 162 m @ 1.42 g/t Pt+Pd+Au (0.61g/t Pt + 0.76g/t Pd + 0.06g/t Au) and 0.47% Cu+Ni (0.28% Cu + 0.19% Ni), incl. 40.67 m 4.5 g/t Pt+Pd+Au (1.92g/t Pt + 2.48g/t Pd + 0.18g/t Au) and 1.26% Cu+Ni (0.89% Cu + 0.36% Ni) in drill hole 11CL0005.

Thunder Bay North

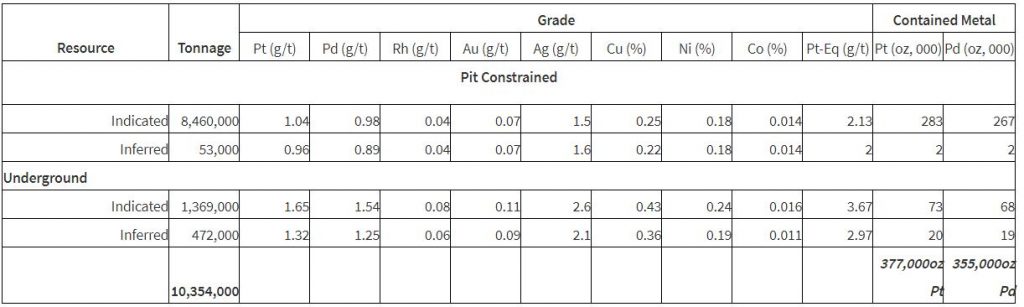

The TBN Project contains the Current, Bridge and Beaver zones of which the following Historical Estimates* are defined:

*Historical Estimate from Thomas, D. et al. 2011: Magma Metals Limited, Thunder Bay North Polymetallic Project Ontario, Canada, NI 43-101 Technical Report on Preliminary Assessment

Mineral Resources and Mineral Reserves at the Thunder Bay North project are considered by Benton to be historic in nature. No qualified person as defined by NI 43-101 has done sufficient work to classify the historical estimates at Thunder Bay North as current. The Company believes that the historical estimates at both deposits can be used as a guide in determining future exploration drilling and the Company will need to undertake a comprehensive review of available data which may include further drilling to verify the historic estimates at either property in order to reclassify them as current mineral resources. The Company’s QP has verified the data but no resampling of core or any other tests on the analytical procedures has been performed by the Company to-date.

Conditions to Closing. The parties’ obligation to close the Proposed Transaction will be subject to specified conditions precedent set forth in the Definitive Agreement including, but not limited to, the following:

- All necessary consents, approvals and other authorizations of any regulatory authorities, shareholders or third-parties being obtained, including but not limited to the approval of the TSXV;

- The parties having negotiated and executed the Definitive Agreement in respect of the transaction;

- The representations and warranties of the parties in the Definitive Agreement remaining accurate at and as of the closing date;

- Regency having entered into a binding purchase and sale agreement to purchase PAN’s subsidiary, Panoramic PGMs (Canada) Ltd. (the “Subsidiary”), owner of the TBN Project;

- Regency having paid $250,000 CAD to PAN, by November 3, 2019, being the deposit otherwise payable by Benton pursuant to the agreement between PAN and Benton for the purchase of the Subsidiary; and

- RTEC having consented to Regency acquiring the RTEC Agreement and PAN having consented to Regency entering into the agreement to acquire the Subsidiary.

QP

Nathan Sims (P.Geo.), Senior Exploration Manager for Benton Resources Inc., the ‘Qualified Person’ under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

On behalf of the Board of Directors of Benton Resources Inc.,

“Stephen Stares”

Stephen Stares, President

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Most projects have an up-to-date 43-101 Report available. Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x231

Email: cathy@chfir.com

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.